Pay raise calculator with overtime

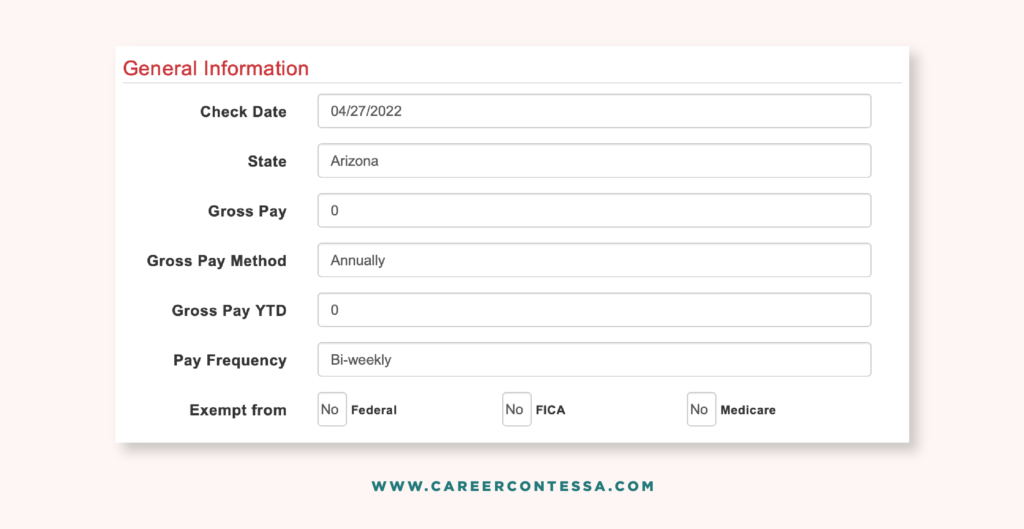

Use monthly gross payment amount. If you are paid 50000 per year enter 50000 in the Before.

The 15 Best Salary Calculators To Help Achieve Fair Pay The Salary Project

Web If you are paid 3025 per hour enter 3025 in the Before Raise Pay Rate edit box and select hour in Pay Is By combo box.

. It can be difficult. Overtime pay of 15 5 hours 15 OT rate 11250. Dont forget that this is the.

Web GET Salaried Overtime Calculator Using the same numbers from the earlier section you can see how this calculator helps you see your overtime pay and at the same time calculates. Web One day this employee works overtime for a total of 2 hours. Twice monthly gross pay x 2 pay periods.

Web Add the overtime pay to the employees standard pay. 5304 g 1 the maximum special rate is the rate payable for level IV of the Executive Schedule EX-IV. Wage for the day 120 11250 23250.

The federal overtime provisions are contained in the Fair Labor Standards Act FLSA. Web Capped Special Rates. 35 hours x 12 10 hours x 15 570 base pay 570 45 total.

Biweekly Biweekly gross pay x. Web The next step is to calculate the amount you should pay the employee after the raise. Web Heres how you can quickly use the Overtime Pay Calculator.

If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for. RM50 8 hours RM625. 1000154 1500 4 6000.

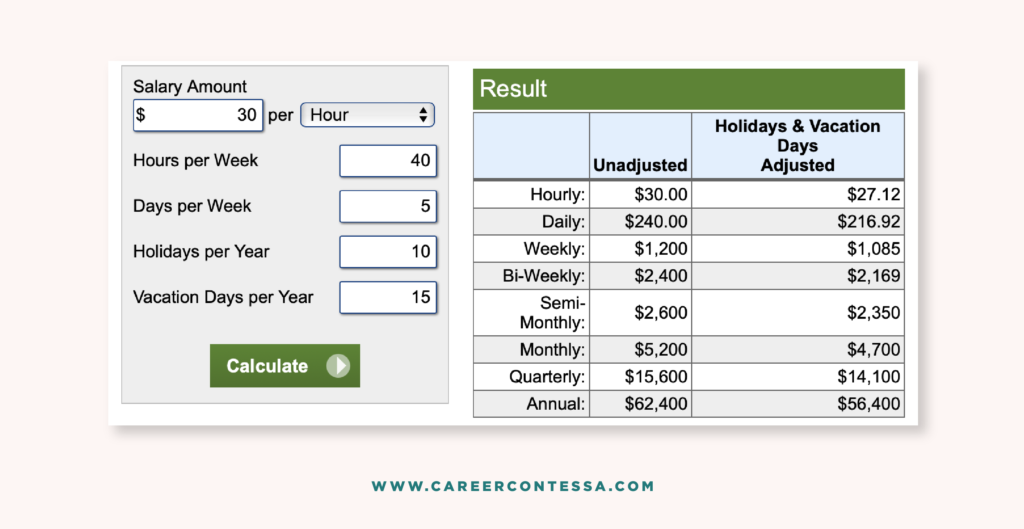

The EX-IV rate will be increased to. Web Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. Web Annual gross pay 12 months.

Step 1 On the Settings portion youll have four options you can change. 8000 6000 14000. Web This employees total pay due including the overtime premium for the workweek can be calculated as follows.

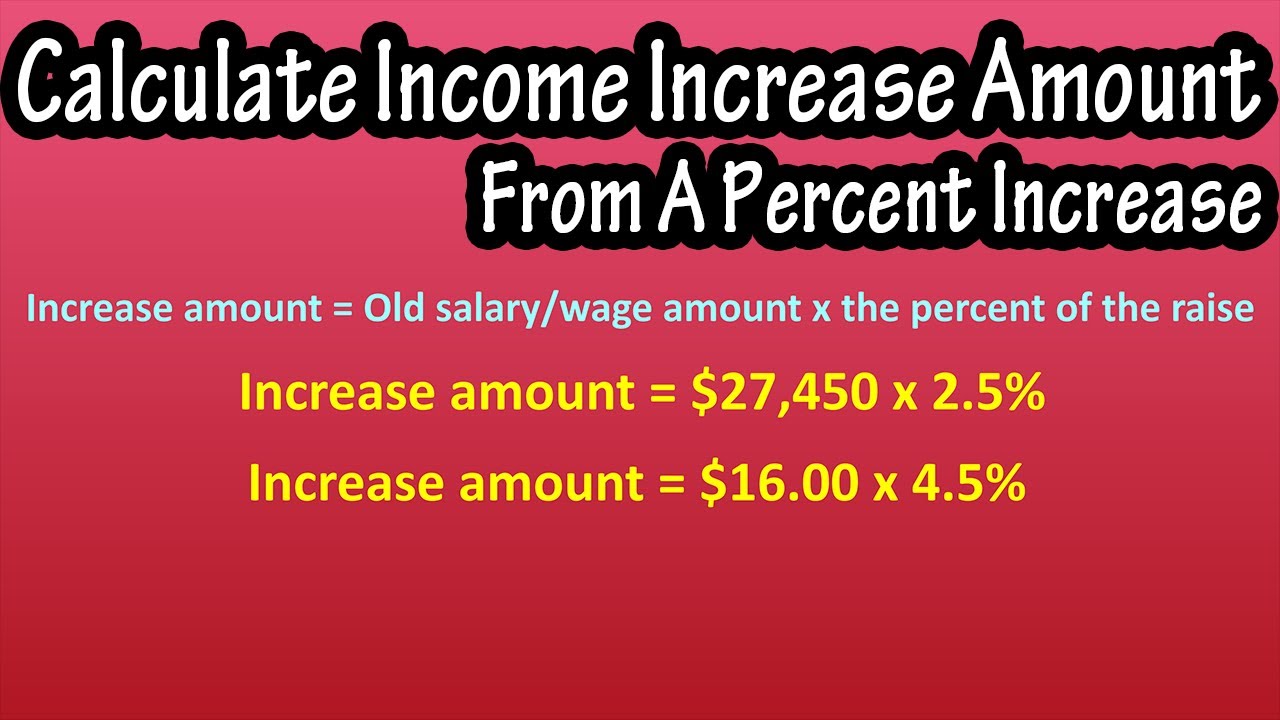

Web Regular pay of 15 8 hours 120. Web This online pay raise calculator will calculate your pay raise or cost of living COL raise based on either a dollar-amount increase or on a percentage increase. Note that the employee should receive the total payment on their usual payday.

Web Enter your current pay rate and select the pay period Next enter the hours worked per week and select the type of raise percentage increase flat rate increase or a new pay rate. Add the overtime pay to the employees standard pay. Retro pay is owed to the employee by you as a result of your retirement.

Divide the employees daily salary by the number of normal working hours per day. Depending on the employer and its incentive policy the overtime multiplier may be. Web Calculate overtime pay for a monthly-rated employee.

Unless exempt employees covered by the Act must receive overtime pay for. Theres Overtime Duration Overtime After. Web To calculate retro pay multiply the difference between 29167 and 2 by 2.

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

The 15 Best Salary Calculators To Help Achieve Fair Pay The Salary Project

Pay Raise Calculator Annual Monthly Hourly

Download Employee Ta Reimbursement Excel Template Travel Insurance Excel Templates Payroll Template

Desk Office Business Financial Accounting Calculate Financial Accounting Circle Logos Inspiration Business Photos

The 15 Best Salary Calculators To Help Achieve Fair Pay The Salary Project

N2yunsaxeopewm

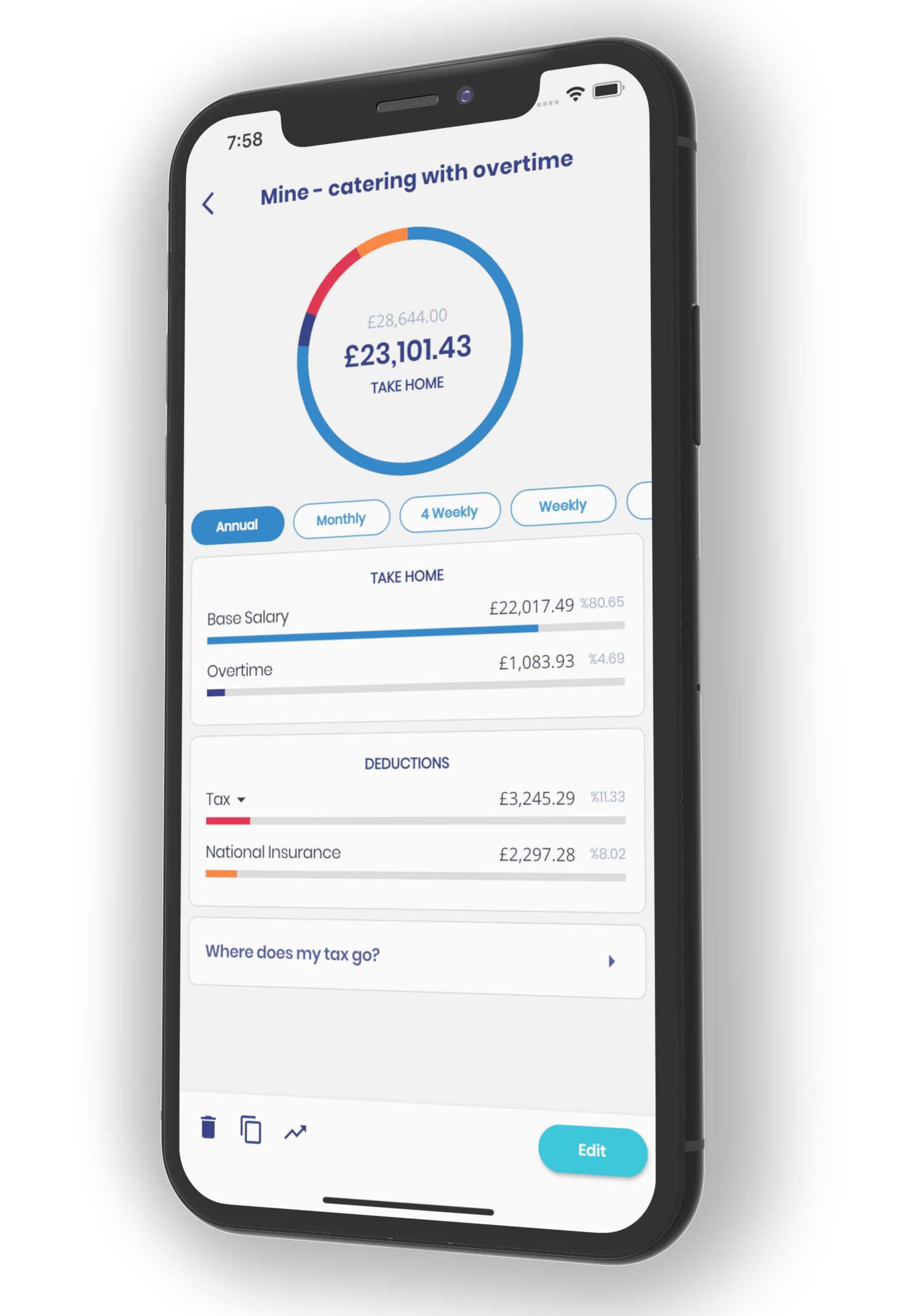

Salary Calculator App

Overtime Calculator Clicktime

Pay Raise Calculator

How To Calculate R Squared Calculator Square Sum Of Squares

How To Calculate Salary Hourly Wage Increase Amount From A Percent Percentage Raise Explained Youtube

The 15 Best Salary Calculators To Help Achieve Fair Pay The Salary Project

Solution To Debt Crisis Infographic Debt Management Plan Debt Relief Debt Problem

Salary Calculator App

Pay Raise Calculator

The 15 Best Salary Calculators To Help Achieve Fair Pay The Salary Project